Elena S. Pikulina

Assistant Professor

Finance Division

Sauder School of Business

University of British Columbia

Email: elena (dot) pikulina (at) sauder.ubc.ca

Phone: +1 604 822 3314

2053 Main Mall, HA864

Vancouver BC

V6T 1Z2 Canada

Download my CV

Working Papers

Biased Promotions, with Daniel Ferreira and Radoslawa Nikolowa.

BibTeX

We present a model of biased promotions in which firm size, wages, and internal labor markets are endogenously determined in a competitive labor market equilibrium. Workers value both wages and job amenities, and differ only by a non-productive label: "Blue" or "Red." Firms favor the Blue group in promotions. The equilibrium features partial segregation: large, high-wage firms employ workers from both groups and offer biased promotion opportunities, while small, low-wage firms hire only workers from the unfavored group and offer stable careers. Although individual firms prefer unbiased promotions, biased promotions collectively benefit firms by weakening worker bargaining power. The model endogenizes firm heterogeneity and helps explain why bias-driven gaps in promotions and earnings may persist even in competitive markets.

Presented at: NBER OrgEcon Meetings (scheduled); CEPR Paris Symposium (scheduled); FMA Meetings, Vancouver (scheduled); RAPS/RCFS Europe Meeting, Cambridge, UK; Barcelona School of Economics Summer Forum; 1st Asian Conference on Organizational Economics, HKU

Award: Wharton School - WRDS Award For the Best Empirical Finance Paper, 2023 WFA (San Francisco, USA)

Presented at:

Northern Finance Association Conference, Calgary (scheduled); The Sydney Banking and Financial Stability Conference; The USC Social and Behavioral Finance Conference; 2023 WFA Meetings; 2023 Eastern Finance Association Meetings; 2023 AFFECT Workshop

We document that over the last two decades, differences in political preferences between U.S. counties have increasingly shaped the equity portfolio composition of wealthy households. This rising partisan portfolio disagreement reflects the growing number of partisan stocks across various industries, particularly among large-cap stocks. The trend appears to be driven more by a widening gap in politically shaped values and an increasingly adverse attitude towards the opposing party, than by differences in politically shaped economic expectations. Our study suggests that the growing political divide can lead to segmentation of U.S. equity markets along political and geographic lines.

Recent literature points to individuals having preferences for autonomy, which has two dimensions. The first is an individual's ability to influence their own outcomes. The second is enjoying a certain degree of non-interference from others. In this paper, we focus on the non-interference in pay. We show that most subjects are unwilling to pay to reduce interference from others when this reduction has no instrumental value. That is, they do not have intrinsic preferences for non-interference. However, those who do show such preferences are willing to sacrifice a meaningful part of their pay to reduce non-interference.

Work in Progress

The cost of financial advice, with Yihui Pan, Stephan Siegel, and Tracy Wang.

Developer competition and housing affordability, with Jack Favilukis and Tianping Wu.

Are mandates for affordable housing effective?, with Khalil Esmkhani and Jack Favilukis.

Who you know still matters: Women on boards and firm value, with Renee B. Adams, Daniel Ferreira, and Benjamin Posmanick.

Publications

Ferreira, Daniel and Elena S. Pikulina.

Subtle discrimination

.

Forthcoming, Journal of Finance.

[Abstract]

BibTeX

Award: Best Paper Award at the CSEF-RCFS Finance, Labor and Inequality Conference (Capri, Italy)

Presented at: Vienna Festival of Finance Theory; 2023 NBER SI, Personnel Economics; 2023 CSEF-RCFS Finance, Labor and Inequality Conference; Adam Smith Workshop Spring 2023; NBER Corporate Finance Meetings, Spring 2023; 2023 FMA Napa/Sonoma Finance Conference; ESCP Workshop on ESG; 2023 AFA Meetings

We introduce the concept of subtle discrimination—biased acts that cannot be objectively ascertained as discriminatory—and study its implications in a model of competitive promotions. We show that subtle (as opposed to overt) discrimination has unique implications. Discriminated candidates perform better in low-stakes careers, while favored candidates perform better in high-stakes careers. In equilibrium, firms are polarized: high-productivity firms become “progressive” and have diverse management teams, while low-productivity firms choose to be “conservative” and homogeneous at the top. Subtle discrimination also has unique empirical predictions in contexts such as equity analysis, lending, fund flows, banking careers, and entrepreneurial finance.

Pan, Yihui, Elena S. Pikulina, Stephan Siegel and Tracy Yue Wang. Do equity markets care about income inequality? Evidence from pay ratio disclosure. The Journal of Finance 77 (2022): 1371-1411.

BibTeX

Award: Best Paper Award, Asian Finance Association Conference 2021 (Shandong, China)

Pikulina, Elena and Chloe Tergiman. Preferences for power. Journal of Public Economics 185 (2020): 104-173.

BibTeX

Pikulina, Elena, Luc Renneboog, and Philippe N. Tobler. Do confident individuals generally work harder? Journal of Multinational Financial Management 44 (2018): 51-60.

Pikulina, Elena, Luc Renneboog, and Philippe N. Tobler. Overconfidence and Investment: An Experimental Approach. Journal of Corporate Finance 43 (2017): 175-192.

BibTeX

Experimental instructions.

Pikulina, Elena, and Luc Renneboog. 14. Serial takeovers, large shareholders, and CEOs' equity-based compensation. Research Handbook on Shareholder Power (2015): 297.

Pikulina, Elena, Luc Renneboog, Jenke Ter Horst, and Philippe N. Tobler. Bonus schemes and trading activity. Journal of Corporate Finance 29 (2014): 369-389.

Drobyshevsky, Sergey, Sergey Narkevich, Elena Pikulina, and Dmitry Polevoy. Analysis of a possible bubble on the Russian real estate market. Gaidar Institute for Economic Policy Research Paper Series 128 (2009).

Data

Download the pay ratio data from my JF paper with Yihui Pan, Stephan Siegel, and Tracy Wang.

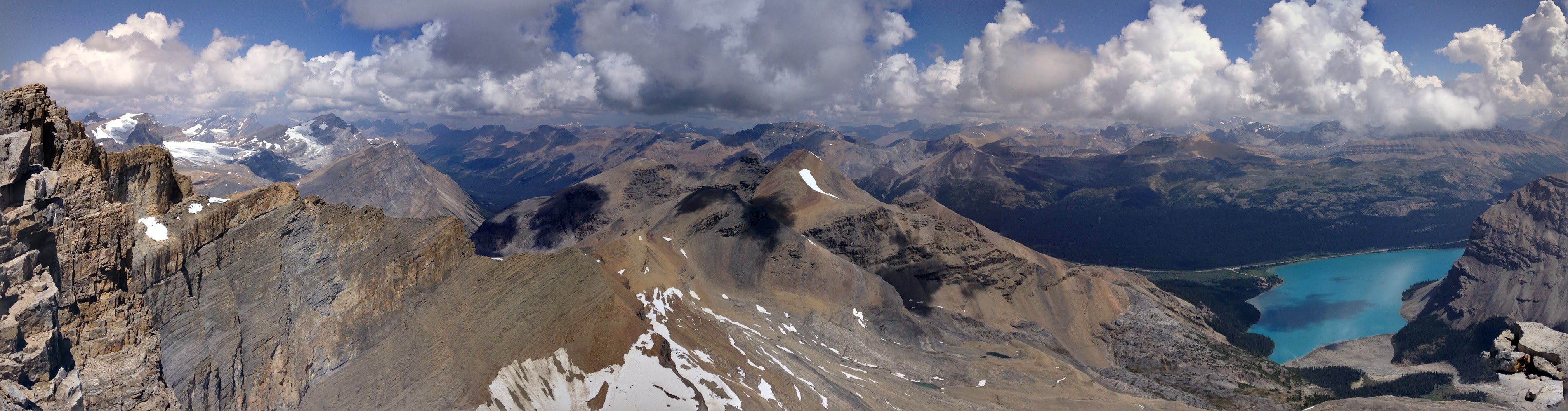

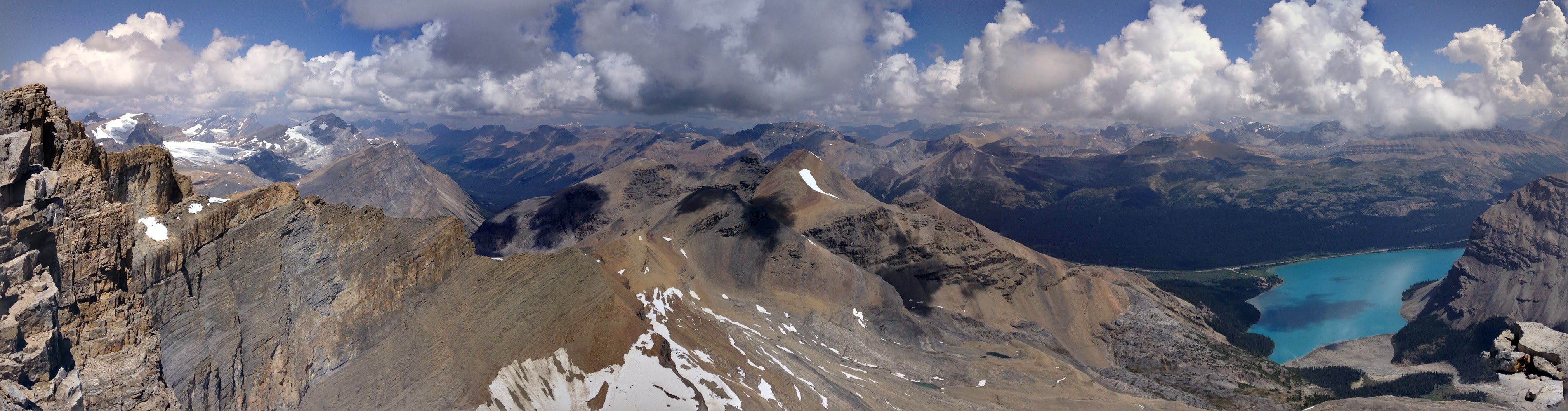

Mount Thompson summit view to the east, Canadian Rockies